Taxes — Taxation are an important idea to own investment held inside taxable accounts. Passively handled investment procedures such ETFs often exchange shorter apparently than mutual finance, resulting in reduced collection return and lower money progress. Should your potential for better taxation performance you like, an ETF could be compatible. Exchange-replaced financing represent an installment-effective way to get contact with a standard basket from securities with a limited funds.

Investing steps using ETFs

U.S. equities over the years underperform across the half a dozen-month Could possibly get–October months compared with the new November–April several months. Additional seasonal development ‘s the inclination out of gold to increase in the September and you may Oct, due to solid demand of Asia before the wedding season and the Diwali festival out of bulbs. Such, suppose a trader could have been purchased the brand new biotechnology market due to the brand new iShares Biotechnology ETF (IBB). There are two main major advantages of periodic investing to begin with. As many economic coordinators strongly recommend, it will make eminent experience to invest on your own basic, that’s everything reach by preserving frequently. Here are the brand new seven better ETF change methods for beginners, displayed inside zero sort of buy.

Their wider field exposure, sector-certain choices, and you will varied resource kinds can also be allow advisors to create customized funding options and you can conform to changing field conditions. Thus, financial advisors would be to very carefully consider their customer’s exposure threshold and you can funding objectives ahead of sharing expertise ETFs. Simultaneously, advisors is always to conduct comprehensive look to spot expertise ETFs with solid song facts, knowledgeable government teams, and you may clear financing tips.

Which are the most widely used ETFs?

ETFs is actually categorised to the security and you will non- https://tradingalchemy.net/ equity (personal debt, item, and you will worldwide) models for income tax motives, affecting their income tax implications. To buy ETFs, over KYC from the submission evidence of label, address, and you can bank facts. Next, open an investments and you may demat membership, since the ETFs must be held inside demat setting and you will replaced within the real-day while in the field days. People can buy ETFs thanks to SEBI-entered brokers otherwise individually via AMCs inside the ‘Creation Unit’ types using profile deposits or bucks.

2Commission-100 percent free trading from Innovative ETFs applies to investments placed on line; very clients will pay a commission to shop for otherwise sell Vanguard ETFs because of the cellular telephone. Commission-totally free change out of low-Vanguard ETFs can be applied only to trades set on line; really members pays a commission to buy or offer low-Innovative ETFs by cellular phone. Vanguard Broker supplies the ability to change the low-Vanguard ETFs used in these offers any time. The ETFs is subject to administration fees and expenses; reference per ETF’s prospectus to find out more. Comprehend the Cutting edge Broker Services payment and you will payment times to possess complete facts. The marketplace price of a keen ETF will depend on the prices of your own holds and you can ties held by the ETF, and business have and request.

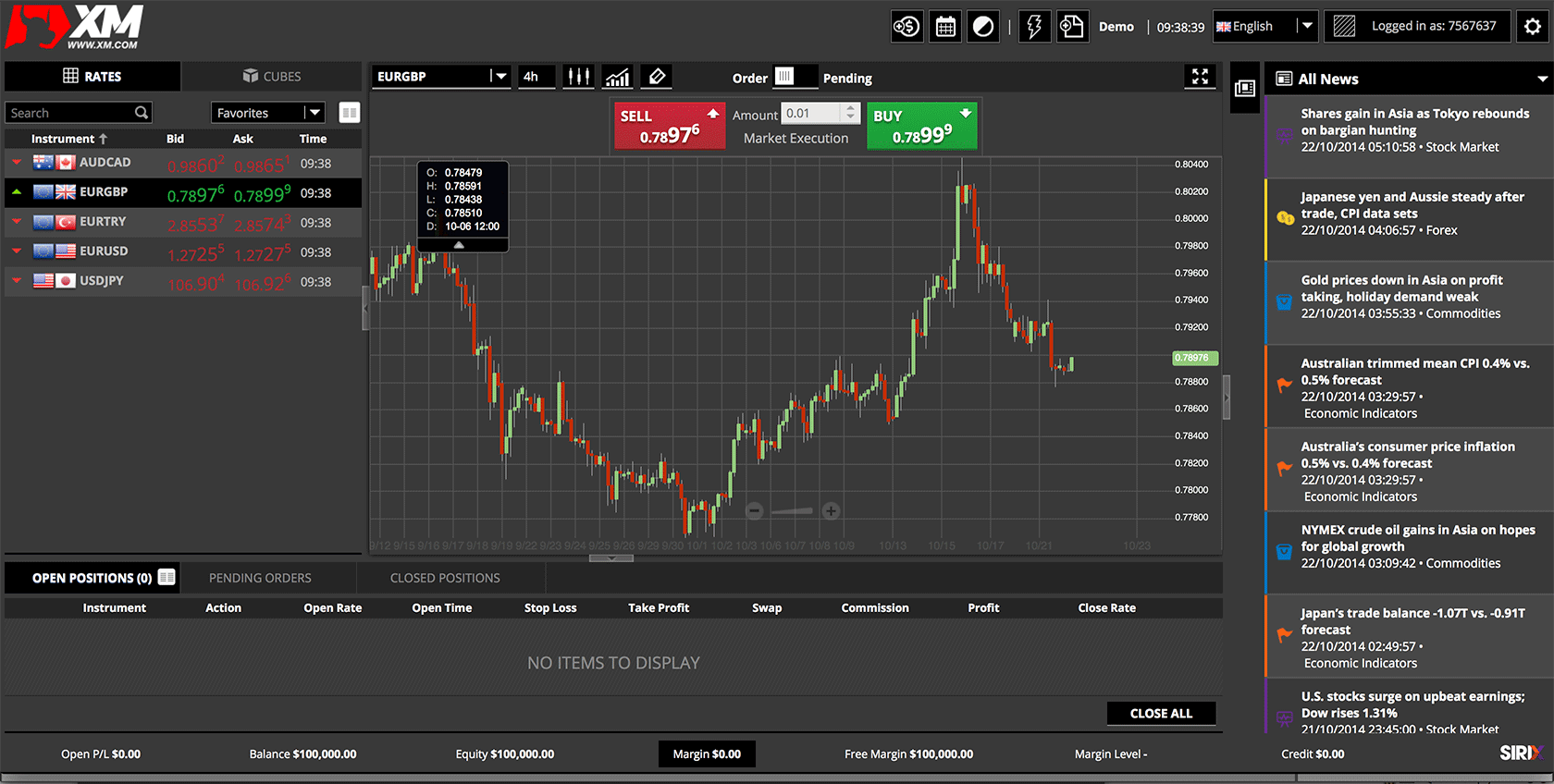

They might as well as hold actual physical a home, as well as many techniques from undeveloped belongings in order to higher commercial functions. The brand new popular features of ETFs which make them suitable for swing exchange try the variation and strict quote-inquire advances. Swing positions attempt to mine considerable speed changes in stocks otherwise almost every other assets such currencies or merchandise.

So it thing cannot create a deal otherwise solicitation in just about any jurisdiction where or perhaps to people to help you who it might be unauthorized or unlawful to do this. “Recommended” blogs and additional suggestions may be available with PNC Investments affiliates, and PNC Bank, PNC Money Government and PNC Institutional Asset Government. Once you’ve had your collection in position, you’ll have to periodically display the profile’s results making one expected alterations. Of numerous, or all, of your own items appeared in this post are from all of our advertising couples just who make up us when you take particular actions on the our very own web site or click to take an action on their website. Our very own lovers never pay me to make certain positive ratings of its goods and services. Diversity does not ensure money otherwise stop loss of a decreasing business.

Actively handled ETFs

They can get or sell these financing in the business rates to the a bona fide-date basis.While the minimum funding quantum is one equipment, there is absolutely no requirements concerning your minimal investment amount. Collateral ETFs is prices-effective and gives transparency regarding their holdings. Such fund end up being the a container out of investment replaced to your replace. The fresh seller pools property for example carries otherwise securities and will be offering offers so you can traders. If you are traders own an element of the money, it wear’t in person own the root possessions.

He previously is actually a reporter on the Wall surface Highway Journal and you will company manufacturer to own CNN.com inside Hong-kong, in which he was founded for almost twenty years. Currency ETFs song a single currency or a container out of currencies and therefore are tend to backed by lender deposits inside the a different currency. Product ETFs spend money on either actual products, including pure tips or metals, otherwise by-product agreements connected to the price of products. While you are a new comer to using, it might be a little while complicated as to what precisely an enthusiastic ETF is actually. ETFs allows you to spend money on a broad segment of a great business, for instance the S&P five hundred or even the Dow, or even in industry general. Influence can also be magnify the newest impression away from adverse issuer, governmental, regulatory, industry, otherwise monetary developments on the a buddies.

Each other help save you the time-drinking works of taking a look at businesses and you may selecting brings, whether or not common finance tend becoming shorter tax-productive and also have highest government charge. When you’re ETFs disclose holdings daily, one generally happens monthly otherwise every quarter which have shared finance. Deals in the shares away from ETFs may result in broker commissions and may create taxation effects. The controlled funding companies are required to help you distribute portfolio development to shareholders. There is certainly zero promise you to a dynamic trade marketplace for offers away from an enthusiastic ETF will build up or even be maintained.

Specialty ETFs cater to specialized niche locations and you may certain investment layouts, bringing concentrated awareness of members having sort of hobbies or expectations. Such ETFs could possibly get focus on sectors for example tech, medical care, otherwise renewable energy, or they might tune larger layouts such as socially in charge using or ESG (environment, social, and you may governance) items. The brand new ETF marketplace is vast and you will diverse, catering to several investment objectives.

Do you generate losses which have ETFs?

You should buy market ETFs during the regular field instances, as well as their prices are according to the market. You can purchase offers from ETFs, just like you can acquire offers out of private stocks. But as you’re to buy section of a financing, you’ll provides founded-inside the diversification. ETFs and shared finance are each other selections of various opportunities, and they is both end up being actively otherwise passively managed. Each other form of money fees costs ratios, however, ETF charge tend to be straight down.

Tips buy and sell products within the ETFs

You ought to cautiously remark the brand new prospectus to possess a keen ETF’s debts ratio. Know that, like with many other investments, you can lose specific otherwise all of the dominating amount you try spending. When you invest in an ETF, you are joining almost every other buyers in the pooling your bank account to invest inside multiple ties concurrently. For every share you get provides you with a small little bit of all defense (asset) within the ETF. Because they’re built to copy a list, passively addressed ETFs give probably lower expenditures and you may better tax efficiency.

They are addressed including normal stocks because they are able to be sold and you will purchased to own an income, and therefore are traded for the a move regarding the change day. Although not, short-promoting ETFs is somewhat safer than shorting private brings since the of your own lower threat of a preliminary squeeze inside the a keen ETF. That’s an investments situation where an asset who may have already been heavily shorted surges higher, forcing small vendors when deciding to take a loss.